What Everybody Ought To Know About How To Buy Mortgage Insurance

Also, note that an insured can switch home insurance companies anytime.

How to buy mortgage insurance. 3 ask about all the itemized fees. The best time to get mortgage insurance is when you are healthy. If you get a conventional loan, your lender may arrange for mortgage insurance with a private company.

You can start a climate risk assessment by checking the federal emergency management agency (fema) website for resources like their flood map service center. A refinancing program that allows a homeowner to avoid foreclosure on their home. This is a type of insurance policy that can help you.

Mortgage protection insurance, or mpi, is a type of credit life insurance, which means you aren’t required to purchase it and it pays the lender instead of your beneficiaries. As a requirement, you must make a 5% deposit and obtain a mortgage to shoulder 75%. The reason lenders require the coverage for down payments below 20% of the purchase price is because you own.

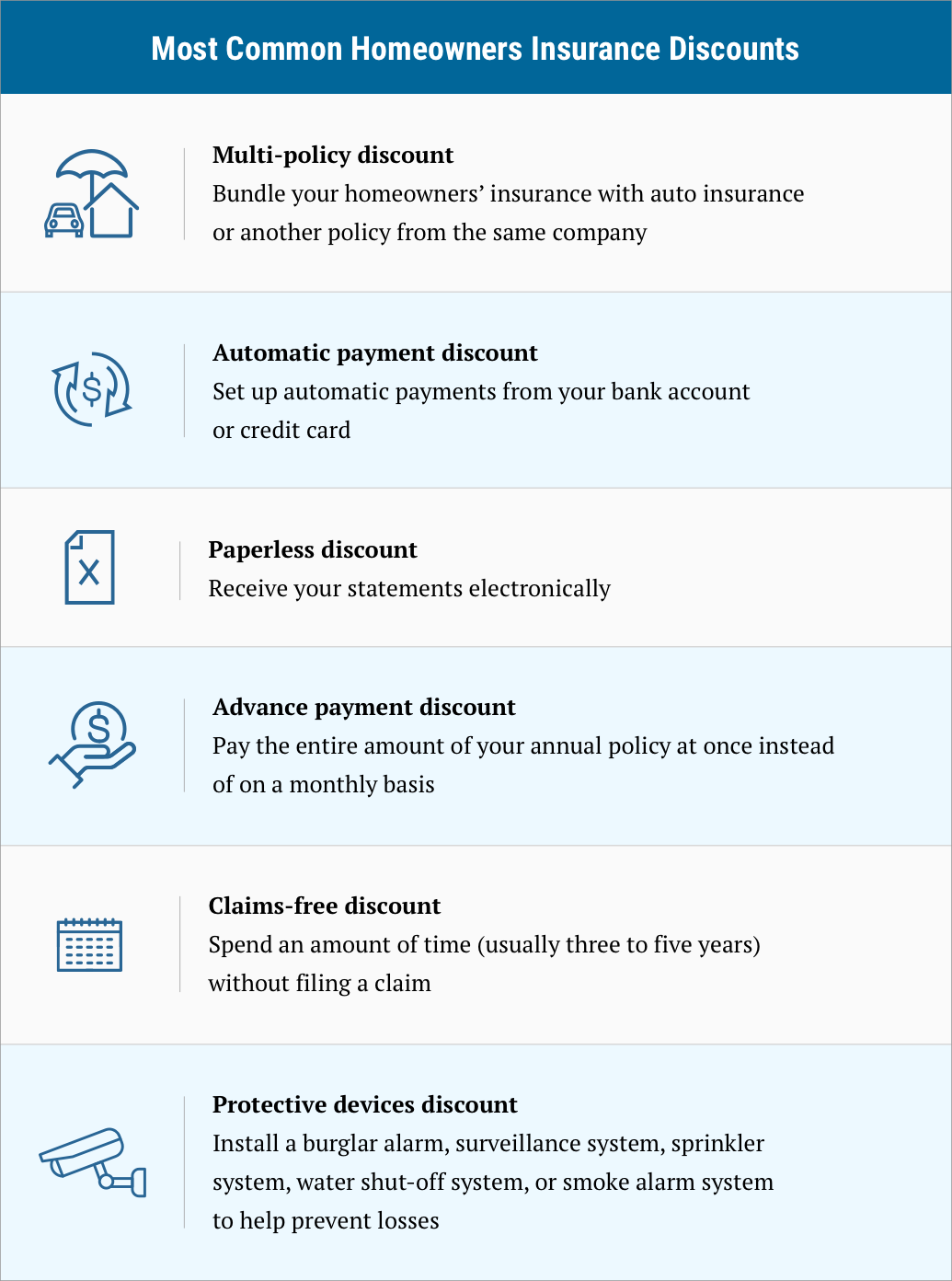

Here are a few ways you can estimate your homeowners insurance needs: Loan types and mortgage insurance conventional loan. This buyout is based on your credit score, and the.

Foreclosure buyouts are typically a refinancing loan which the. If you buy a mortgage protection insurance policy, you’ll continue to make monthly premium payments for the duration of the policy term. Dont make the mistake of waiting until you become uninsurable to apply for coverage.

Your military service can help you buy a home—and. Calculate the cost to rebuild your home, plus any outbuildings or structures such as a garage,. A lower deductible increases your insurance premium.

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-private-mortgage-insurance-pmi-and-mortgage-insurance-premium-mip-Final-fc26360e02cc4b30af01326412b49cf0.jpg)

/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)