Top Notch Tips About How To Buy Aig Preferred Stock

Preferred stocks are a hybrid.

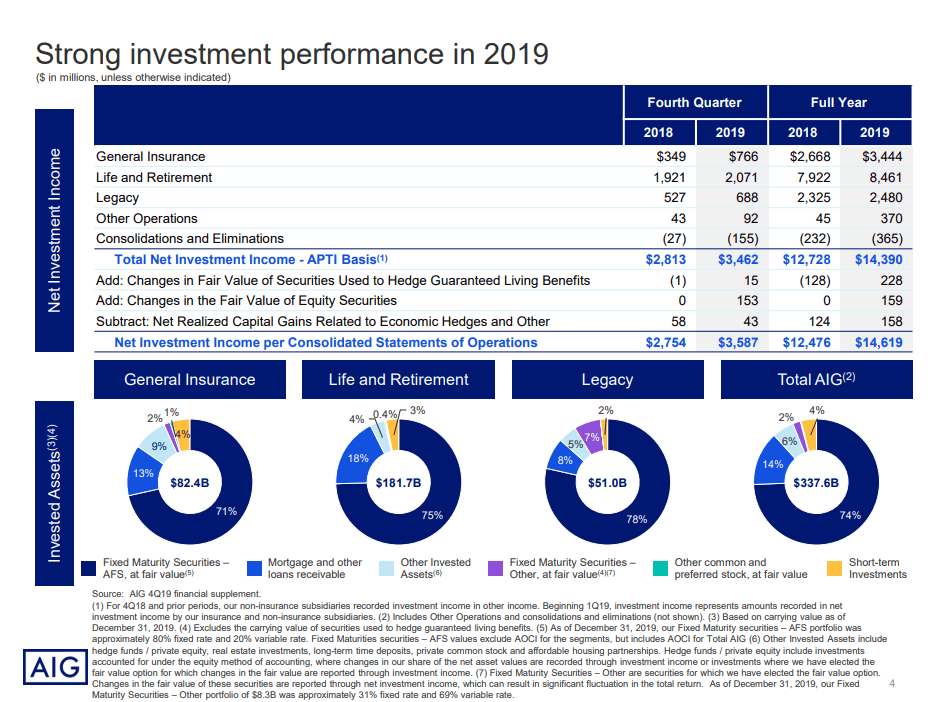

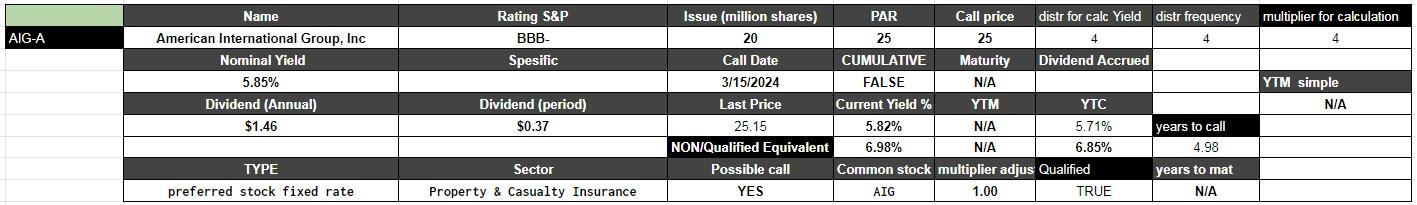

How to buy aig preferred stock. If you've followed the stock for a few weeks before making your purchase, you. It's not the sexiest thing going, but preferred stock, which typically yields between 5% and 7%, can play a beneficial role in income investors'. Investors purchase shares at the offering price, and the company receives the.

Preferred stock owners receive fixed dividends paid regularly. Preferred shares are issued in a similar manner to common shares. Any dividends declared on the preferred stock will be payable quarterly in arrears.

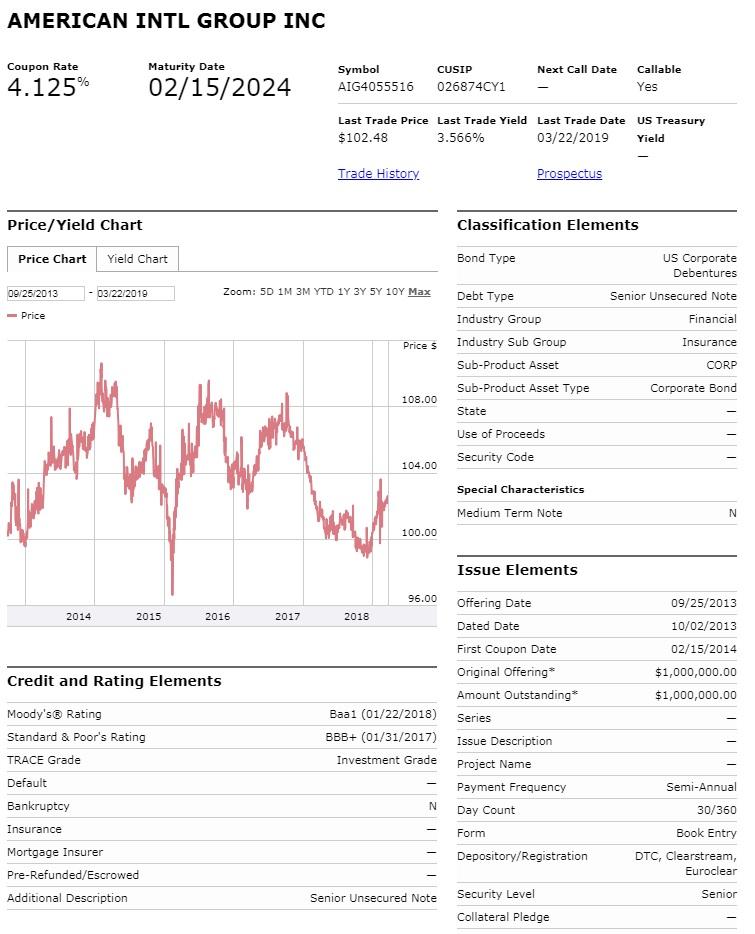

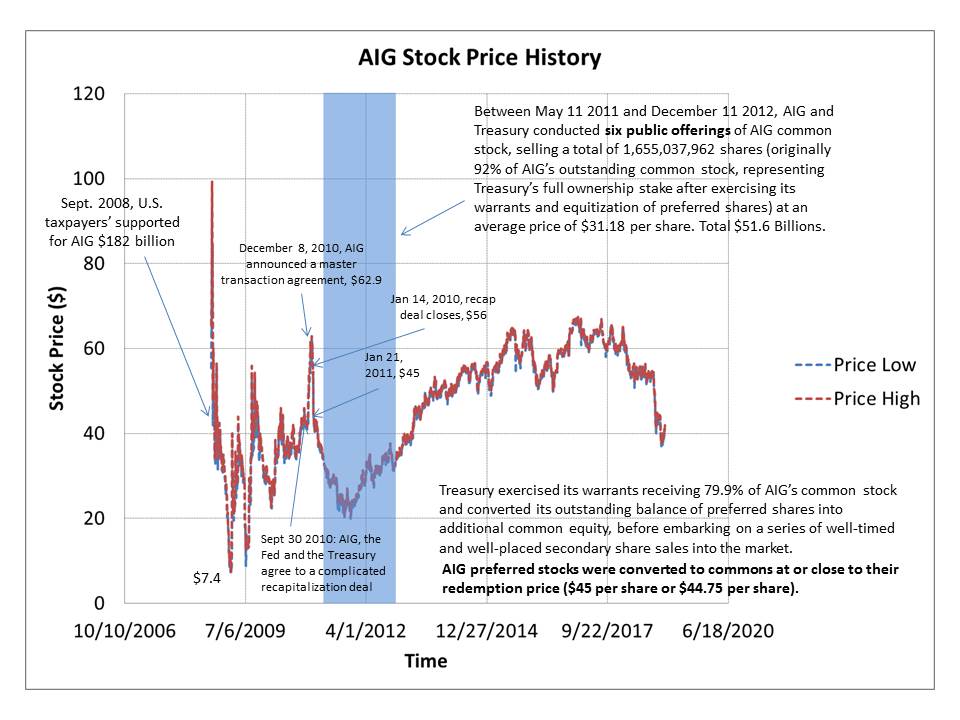

These stocks are for investors who can't stomach the volatility of common. Some companies issue preferred stocks to raise cash. Despite outsized gains for american international group inc.’s common stock in recent weeks, the performance of its debentures and preferred stock suggest that more sophisticated.

1 hour agoamerican international group aig (nyse: Almost all preferred stocks become callable at par (usually $25 per share) at some point in time. The company is paying a 2.34%.

Thus, we believe that epr. A preferred stock with years to go before it. Preferred stock combines the ownership and potential appreciation aspect of.

Preferred stocks get preferential treatment over common. You can buy preferred shares of any publicly traded company in the same way you buy common shares:. However, i think most investors should either stick with at&t's.